The approval of the increase in the 2014 allowance for Section 179 is creating a lot of buzz in the dental industry. It seems like Section 179 promos always spring to life at the end of the year, every year.

So, what is the buzz all about? It’s because you have a limited time to act – and save tremendously. Choose to invest in a solution that brings additional revenue to your practice, like the WaterLase iPlus, and you can save plus generate new revenue and attract new patients.

Here are 7.9 things that you should know about Section 179 and your dental practice.

- Section 179 is intended to help you invest or re-invest in the future of your company, by offering a tax break on capital equipment. For the dentist, this can include major purchases to help make procedures more efficient – such as dental lasers, 3D scanning, Intra-oral scanners– as well as investments to make your office more attractive such as new dental chairs. Nearly all business-use equipment qualifies as a deduction.

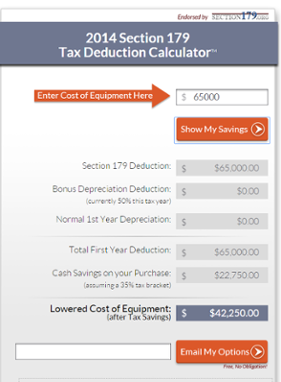

- The increase in 2014 limits to $500,000 could save you $22,750 on a WaterLase iPlus, or over $50,000 on a NewTom VGi. Consider this scenario:

See what you can save with the Section 179 Savings Calculator.

- Use Section 179 to achieve your personal business goals! Want to offer a new procedure to your patients to help retain them in your practice? By incorporating the supporting equipment in 2014, you can deduct the full purchase price and achieve your business development goals.

- The Section 179 Deduction is now $500,000 for 2014. Any excess above the allowable deduction can be depreciated over five to seven years, depending on the type of equipment. Additional amounts may be expensed as per applicable depreciation schedules.

- Unlike depreciation, which spreads the deduction over a period of years, this provision allows businesses—including dental practices—to write off the total price (up to $500,000). That’s the incentive to invest within the current tax year, and the basis for Section 179.

- The law allows taxpayers to use Section 179, bonus depreciation, and regular accelerated depreciation all on the same property. Not sure how that affects your practice? It means you lower your tax burden in the near term and gives you more money today.

- Capital leases qualify for a tax deduction for the year they are placed in service. This means your purchased equipment must be in use by the end of December 2014. This can be challenging for a dental office that is busy during the end of year production rush, but can also bring increased opportunities for the end of the year.

7.9 In case you were wondering, to qualify for Section 179, your investment must be tangible personal property purchased from a non-related person for business-use. Purchasing a Ferrari doesn’t count, but investing in a WaterLase iPLus with Ferrari red paint to benefit your practice and your patients does!

Section 179 was first drafted by congress in 2008 as part of the Economic Stimulus Act. The purpose was to help stimulate economic growth through business development, by giving small businesses a tax break on capital equipment. At the start of January 2014, the deduction was a mere $25,000 – not much of a break. With the deduction up to $500,000 you can make a big impact on your practice efficiency by the end of the year.

Ask your tax advisor for details!!